Invest With Ignite Capital

Ignite Capital Fund II continues the mission of supporting social enterprises in Baltimore's historically under-invested communities, while expanding its reach and impact. Building on the success of Fund I, Fund II seeks to further close the racial wealth gap by providing creative and flexible capital solutions to Black/POC-led enterprises, with a focus on increasing local economic resilience and sustainability.

FUND HIGHLIGHTS

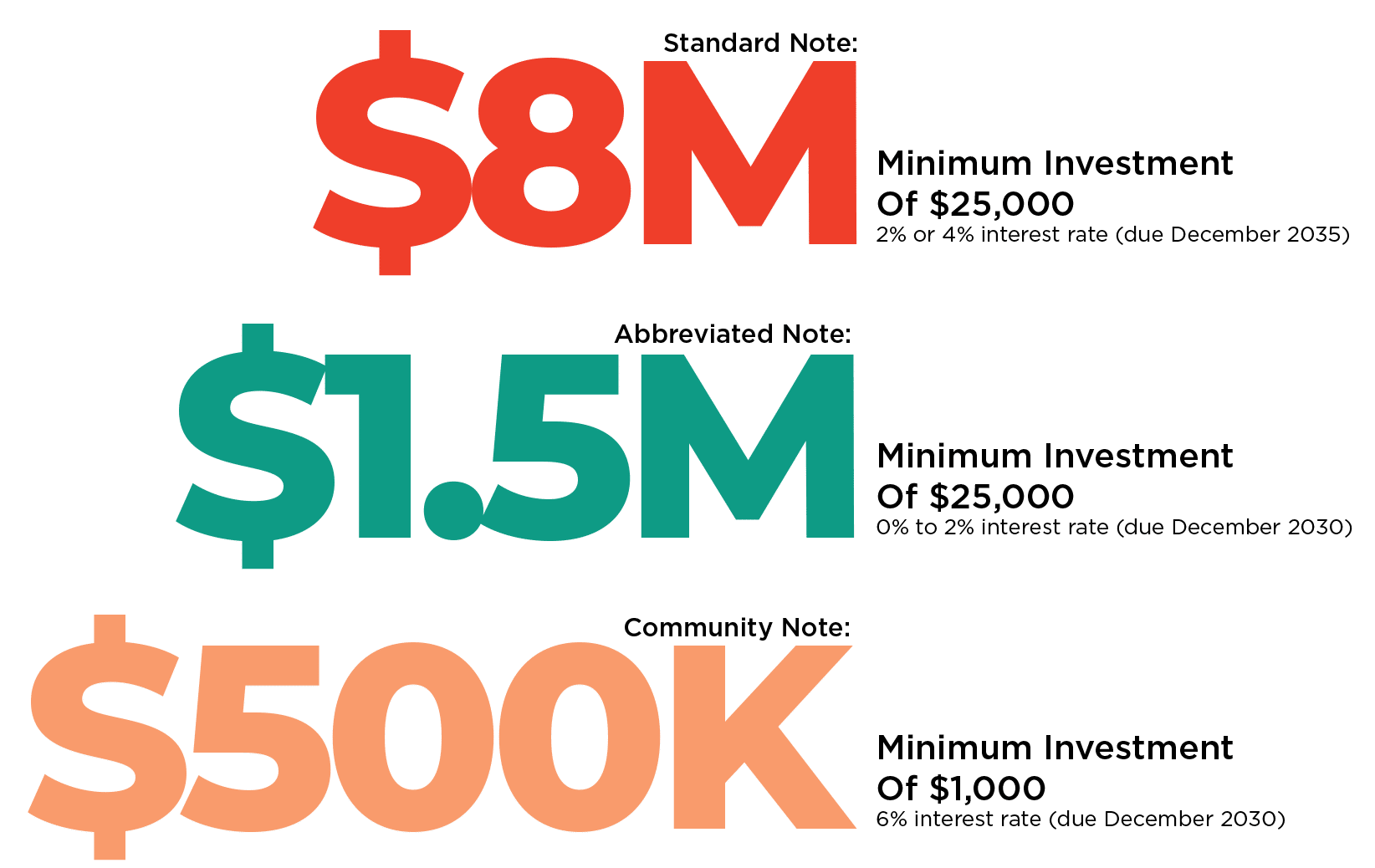

Offerings

How We Do It

We connect communities, entrepreneurs, and investors to build stronger local economies across Baltimore city.

1. Social Enterprise Support:

- Holistically supporting Baltimore’s social enterprises, meeting them where they are, to drive economic equity in Baltimore

2. Connecting Enterprises to Markets:

- Positioning enterprises for institutional relationships and facilitating market opportunities

3. Rooted in Neighborhoods:

- Through trust-centered relationships, connect neighborhood assets to ensure enterprises can operate sustainably in communities

4. Bridging Access to Capital:

- Through Ignite Capital, deploy mission-centered financial capital to incentivize and sustain enterprise growth and community benefit

Portfolio Impact and Growth Projections

Fund II will continue to build on the strong impact of Fund I, with a focus on scaling enterprises that create meaningful social and economic benefits. By increasing the pipeline of social enterprises served, Fund II aims to further amplify job creation, wealth-building, and community impact.

Job Creation

• Continued focus on creating both full-time and part-time employment opportunities for local residents, particularly in sectors that contribute to long-term economic sustainability.

Co-Investment Impact

• Similar to Fund I, Fund II aims to attract additional capital through co-investment opportunities, increasing total funding available for portfolio companies.

Governance and Risk Management

Ignite Capital Fund II will build upon the robust governance framework established by Fund I. The fund will continue to implement a conservative risk management strategy, including maintaining an adequate loan loss reserve, and leveraging guarantees from partners like the Abell Foundation to ensure protection for investors.

Governance Expansion

• Continued development of board, finance, and investment committees to ensure effective decision-making and alignment with Fund II’s objectives.

Risk Management

• Fund II will continue to prioritize prudent investment practices with a focus on maintaining a strong balance between risk and impact.